|

.

|

|

|

|

British Try To Save $9 Trillions by Killing Billions

by Dennis Small

April 24—The International Monetary Fund, the British Empire's planetary policeman for fascist economic policies, issued its semi-annual Global Financial Stability Report in mid-April, warning of an imminent $3.8 trillion meltdown of Eurozone banks—about 10% of the assets on their books—which could spread to the United States ``through derivatives markets.'' Made public on the eve of the April 20-22 IMF-World Bank meeting in Washington, D.C., the published version of the report was rewritten to vastly understate the actual magnitude of the blowout. A senior finance ministry official attending the meeting told EIR that an earlier draft version, seen by the source, had painted a much worse picture of the non-performing debt on the books of the big European banks, concluding that at least $9 trillion would be needed to bail out the private European banks this year.

Senior U.S. intelligence sources had reported earlier this year, around the time that the European Central Bank (ECB) had opened its hyperinflationary trillion-euro bailout window known as LTRO, that the European banks would need an estimated $8 trillion to avert total meltdown in 2012. In other words, nearly 25% of the face value of all the financial assets on Eurozone banks' books is worthless—by London's own admission. And that is really just the tip of the iceberg. As Lyndon LaRouche has repeatedly warned, the entire trans-Atlantic system is hopelessly bankrupt. ``We are having a collapse of the existing empire,'' LaRouche stated on April 21. ``It's disintegrating, disintegrating economically and every other way.... |

|

|

|

|

- British Try To Save $9 Trillions by Killing Billions

The IMF, Britain's planetary policeman for fascist economic policies, issued its semi-annual Global Financial Stability Report in mid-April, warning of an imminent $3.8 trillion meltdown of Eurozone banks. But a senior finance ministry official attending the meeting told EIR that an earlier draft version, seen by the source, concluded that at least $9 trillion would be needed to bail out the private European banks this year. As Lyndon LaRouche has repeatedly warned, the entire trans-Atlantic system is hopelessly bankrupt.

- Antonio Maria Costa:

Former UNODC Head Talks About Drugs in the World Banking System.

Dr. Costa has been at the center of efforts for almost 30 years that have investigated the interface between organized crime and banking, particularly efforts on money laundering.

Economics

- Unless Obama Policy Is Dumped:

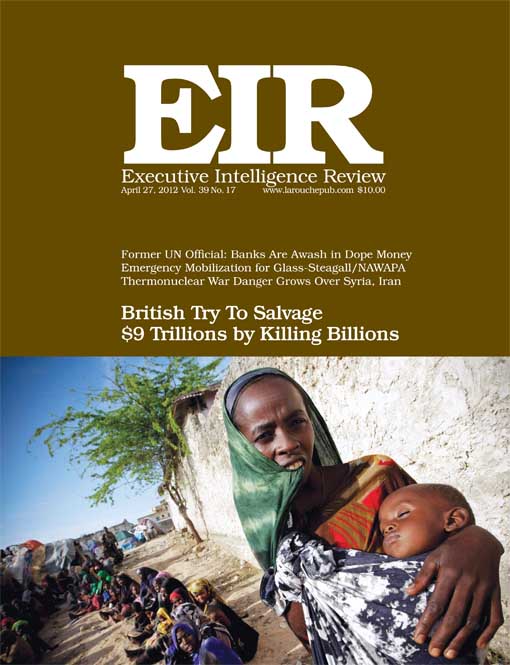

The Lives of 30 Million Africans Hang in the Balance

Emergency food aid and high-tech water and agroindustrial projects are now a life-or-death requirement for 30 million people from the West Sahel through the Horn of Africa. Yet leading transAtlantic government officials are merely spouting sentimental rhetoric; they are condoning genocide by failing to take the measures needed.

- Battle Against ESM Expands Across Europe

The German Bundestag is scheduled to approve the Fiscal Compact and the European Stability Mechanism on May 25. Thus, only a few weeks remain for the opponents of this codification of bank bailouts and austerity to mobilize to stop it. But, resistance is growing.

- Argentina Flanks the Empire, Re-Nationalizes YPF Oil Firm

Argentine President Fernández's announcment that she had signed a decree expropriating 51% of the formerly stateowned YPF company, held by the Spanish oil firm Repsol since 1998, has enraged the financiers of London and Wall Street, who are howling that she has 'broken the rules!'

International

National

Music & Culture

Interviews

- Dr. Antonio Maria Costa

Antonio Maria Costa was the Executive Director of the United Nations Office on Drugs and Crime (2002-10). In 2009, he stated in an interview, that massive cash flows from the global narcotics trade were brought into the banking system to rescue banks after the interbank money markets shut down.

|

|

|

Subscribe to EIR Online

For all questions regarding your subscription to EIR Online, or questions or comments regarding the EIR Online website's contents or design, please contact eironline@larouchepub.com.

All rights reserved © 2012, EIRNS |

|

|